Roles and relationships in the digital financial ecosystem

Solvinity previously published a blog entitled “The digital financial ecosystem under the microscope“. This blog describes three groups of actors in the financial ecosystem: customers, service providers and external service providers. In a modern digital ecosystem, however, more roles can be defined. Each of these roles has its own responsibilities and duties in sustainably maintaining a healthy digital ecosystem. Solvinity recognises the importance of this, which is why we are committed to creating an ecosystem that is sustainable, innovative and secure.

“As CCO of Solvinity, I strongly believe in the power of digital ecosystems and the role different actors can play in them. In an ever-changing world, it is essential to find the right balance between these roles and the responsibilities they entail. The strength of a financial digital ecosystem lies in its ability to find sustainable solutions to complex challenges. At Solvinity, we are committed to creating a resilient ecosystem that allows all its participants to thrive in a world of opportunity” – Nancy Roos – Beukers, CCO of Solvinity

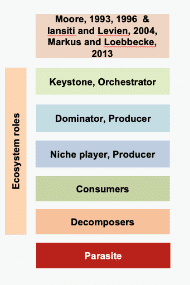

This figure shows a number of roles that are crucial to a healthy digital ecosystem. In the financial world, both producer roles are fulfilled by service providers (dominator) and external service providers (niche players), with the filling of the consumer role obvious. But who fulfils the other roles in a financial ecosystem, digital or otherwise? And what behaviours are associated with it?

The decomposer in a digital financial ecosystem

In a properly-functioning financial ecosystem, dealing with the inevitable financial waste is of crucial importance to the ecosystem. By financial waste, we mean any potential situations not intended by the producers. For example, a loan or premium that is no longer being paid or a business that has collapsed to the point where it can no longer be reasonably expected to become profitable.

Decomposers (reducers) are the actors assigned to process this financial waste. These might include organisations such as receivers, debt collection agencies, NPA (non-performing assets) buyers, and the like. Just like in a bioecosystem, these financial reducers help relieve the producer of the worry of “financial waste”, thereby affording it air and space to fulfil its primary role; reducers also ensure that this same waste is given the opportunity to regain usefulness. The reducer benefits from the proper waste disposal that is necessary to sustain its own existence, which makes it better suited than the producer to deal with the waste.

Changing times call for multiple types of orchestrators

The diagram above shows another ecosystem role, i.e. the orchestrator (director). This is a role that is emerging in a bioecosystem – not as an organism, but rather as the set of conditions within which the ecosystem thrives. This is given structure in the financial ecosystem, be it digital or otherwise, in the form of legislation and regulations put in place by, for instance, the Ministry of Justice and Security, De Nederlandsche Bank (the central bank of the Netherlands), the courts, the Netherlands Authority for the Financial Markets (AFM), etc., as well as softer influencers such as public opinion.

The role of an orchestrator in a digital ecosystem is to attract new actors, facilitate interactions between actors, resolve tensions, etc. These are all activities in the interest of the ecosystem and aren’t motivated by individual interest.

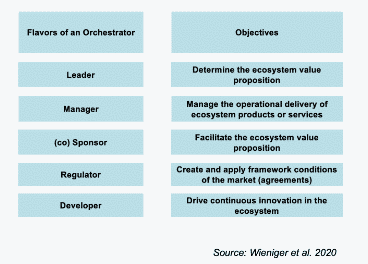

A digital ecosystem is of dynamic importance and is continuously changing over time and according to circumstances. As such, we recognise a whole series of orchestrator types, as included in the inset.The financial sector is in the midst of digitalisation. As part of this, new specialist niche producers are coming on board, with data reg ularly being shared and complexity increasing. Legislation and regulations have to work hard to keep up with reality; the value and operation of digital ecosystems need no further encouragement.

However, when it comes to the concern of allowing everyone to benefit from such ecosystems in a healthy way, thus maintaining the balance between big and small, it is precisely this director role we need most at this point in time: regulator and developer. Only when these director roles are properly filled will we be in a position to ensure the financial ecosystem remains healthy, thereby retaining as many participants as possible, with a human dimension, and with a future full of innovations that aren’t going to bite us in the tail.

More information about digital ecosystems

At Solvinity, we are committed to fulfilling our role in the best possible way by actively collaborating with chain parties. We seek this collaboration not only with our customers and their partners, but also in a national context. A specific example of this is our partnership with the Digital Ecosystems Institute, where we work with bodies such as Nyenrode Business Universiteit towards fostering collaboration in digital services. More information can be found here.

This blog has been co-authored by John de Voogd, consulting partner linked to DEI. He is an enthusiast with a strong commitment to the opportunities that collaboration, digitalisation and transparency can contribute to business success for companies and social success for authorities. John sees DEI as an incubator that can create this kind of success in complex environments that are willing to take on the challenge of finding solutions to “wicked problems”.

Sign up for the Solvinity Newsletter

Receive the latest news, blogs, articles and events.

Subscribe to our newsletter.

Other articles

More

Take Control of Your Security Strategy with the NIST Framework

Discover how the NIST Framework helps you structure your security approach and keep risks under control...

READ MOREWhat makes a Secure Managed Cloud truly ‘secure’?

What makes a Secure Managed Cloud truly ‘secure’? In an era where cyber threats are constantly...

READ MOREThe complexity of IT Regulations for municipalities

In addition to the daily challenge of managing a secure and efficient IT environment, municipalities face...

READ MORE